The NextGen charity giving card is here!

Fundd issues charitable giving cards with built-in spend rules, bank grade security and automated single tax deductible receipts on every swipe.

Try efficient, paperless, compliant charitable giving. Today

Control

Ultimate control on every swipe

- Spend rules are enforced on charitable giving cards in real-time during every swipe. Set individual spend limits, select allowed categories, special fundraiser, or days and times when card work.

- Keep track of your transactions online, with extensive reporting and searching tools.

- Just one gift aid declaration. Tell us if you're a UK taxpayer and we'll claim Gift Aid for you. You'll then get an extra 25p added for every £1 you pay into your account.

- Be confident in giving to charity. We verify and check your chosen charity is legitimate before we send them your donation.

Tax Deductible Receipt

Automated collection of receipts

- No need to chase after and retain receipts for all your donations.

- Efficiently donate to international organisations.

- Keep track of your transactions online, with extensive reporting and searching tools.

- Receive monthly statements.

- Opt in to receive a SMS/Text message when your account is low.

- Replace vouchers with a charity giving card.

Real-time

Come for our cards, stay for everything else.

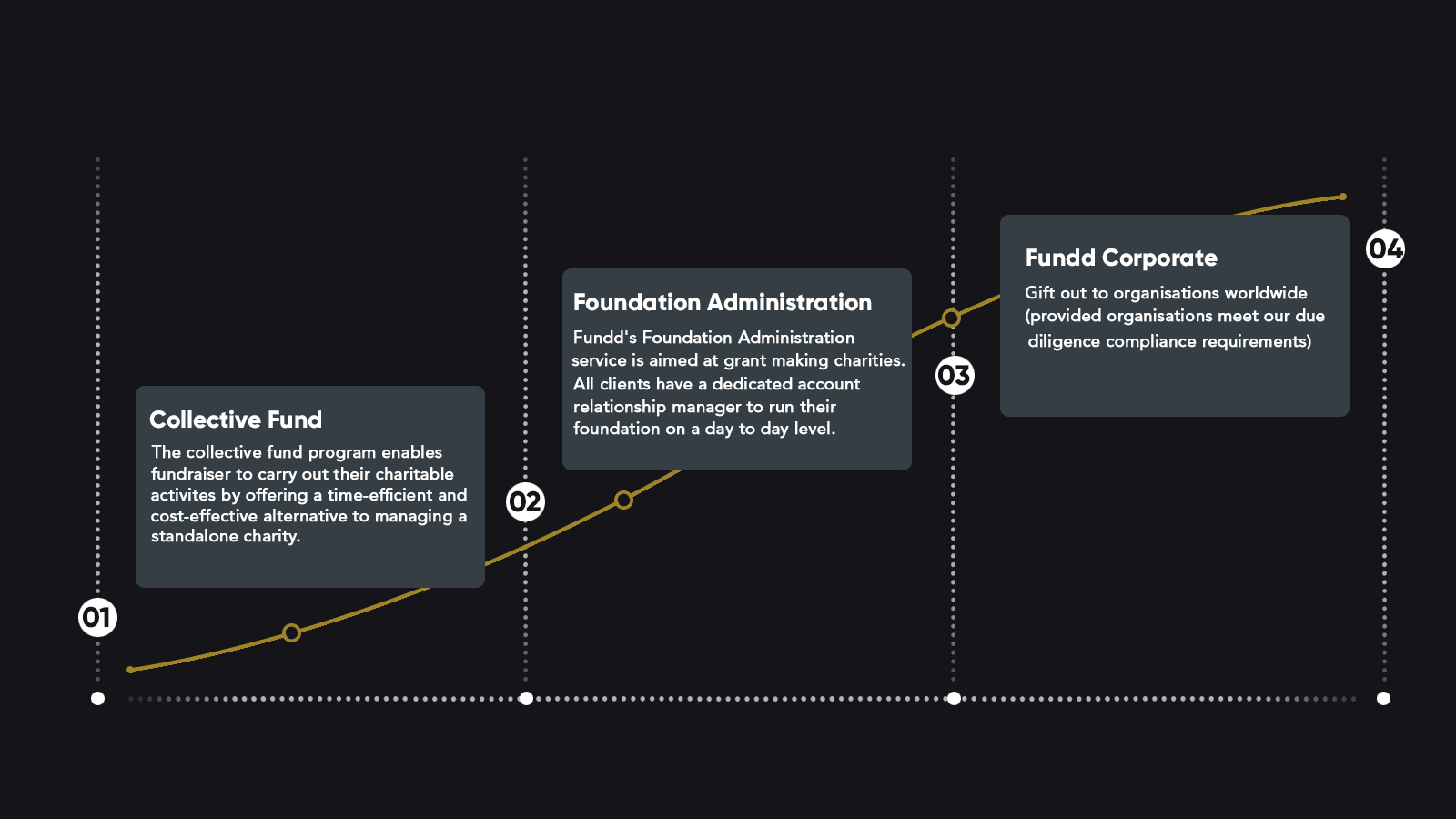

- You open an account with Fundd

- You make one (larger) donation to Fundd

- You are given a giving card and portal login details to an online account – you can then make smaller donations – to charities of your choice.

- On your tax return you simply record Fundd details as the recipient of this donation.

- Fundd keeps track of all your donations and provide regular statements and (online) access to special reports – making it easier to track your charitable donations